It's 100% free to see, and start monitoring your credit score from Australia's credit bureaus.

Know your chances for approval, and open up better rates with a strong credit score.

Banks, lenders, even telco and utility companies all look at your credit score.

Getting your credit score only takes a couple of minutes.

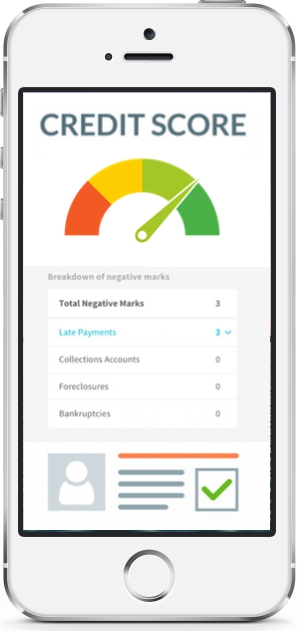

Learn what's behind your credit score, and how you can improve on it.

Get exclusive & personalised offers on credit & other relevant products.

Clear and simple answers for even the most savvy of us

A credit score is a number that helps credit providers know how responsible you are to lend to. The score comes from your credit report which looks at your situation and your past behaviour.

An Equifax Score is provided by GetCreditScore.com.au, and has credit information on 18 million Australians, and is used by most lenders and credit providers within Australia.

There are three kinds of credit scores being promoted to Australians, each with its claims of unique benefits, so how should you choose the right credit score?

Here’s our advice: Get a credit score based on the credit bureau that lenders actually use to make credit decisions about you. Your Equifax credit score, which is used each and every day by Australian lenders making thousands of credit decisions, is the one you need to know.

You can get your Equifax credit score for free, via GetCreditScore.com.au.

Your credit scores and credit reports can be obtained by different kinds of organisations:

Banks. If you’re opening an account, the bank may pull your credit to check your creditworthiness, even if you don’t have a credit card attached to the account.

Creditors. Credit card issuers, car loan lenders and mortgage lenders — can pull your credit score. Credit history is a major factor in determining (a) whether to give you a loan or credit card, and (b) the terms of that loan or credit card.

Utility & Mobile Phone providers. When you set up electricity, gas or a mobile service, the utility company may pull your credit info.

Credit scores are used by most lenders. They’re important to have if you ever decide to purchase a home, a car, or even something as simple as a new mobile phone, or connecting your electricity. Credit scores can range anywhere from 0 to 1200. The higher your score, the more money you can typically borrow and the less you have to pay for a loan. A low score can be considered “high risk.”

Bankruptcy, late payments or referrals to collection agencies can all affect your score negatively and this information can remain on your credit score for several years.

To know & monitor your credit score for free, visit GetCreditScore.com.au.

If your score is at the higher end, you may be eligible to negotiate for a better rate than what you currently have or have been quoted. On the other hand, if your score is toward the lower end, you may be able to find a provider that caters to your needs.

Via GetCreditScore.com.au, you can find out your credit score for free, and then see a number of offers on varying products, where some are customised to your credit score.

Equifax, previously known as Veda, operates as the leading credit bureau in Australia. A credit bureau is a company that collects and maintains people’s credit information and provides it to lenders, creditors, and consumers in the form of a credit report.

Credit bureau’s like Equifax exist to report on the credit worthiness of an individual which is valuable to credit providers such as Banks, utility providers and other lenders.

A credit score is a number that helps credit providers know how responsible you are to lend to. The score comes from your credit report which looks at your situation and your past behaviour.

An Equifax Score is provided by GetCreditScore.com.au, and has credit information on 18 million Australians, and is used by most lenders and credit providers within Australia.

There are three kinds of credit scores being promoted to Australians, each with its claims of unique benefits, so how should you choose the right credit score?

Here’s our advice: Get a credit score based on the credit bureau that lenders actually use to make credit decisions about you. Your Equifax credit score, which is used each and every day by Australian lenders making thousands of credit decisions, is the one you need to know.

You can get your Equifax credit score for free, via GetCreditScore.com.au.

Your credit scores and credit reports can be obtained by different kinds of organisations:

Banks. If you’re opening an account, the bank may pull your credit to check your creditworthiness, even if you don’t have a credit card attached to the account.

Creditors. Credit card issuers, car loan lenders and mortgage lenders — can pull your credit score. Credit history is a major factor in determining (a) whether to give you a loan or credit card, and (b) the terms of that loan or credit card.

Utility & Mobile Phone providers. When you set up electricity, gas or a mobile service, the utility company may pull your credit info.

Credit scores are used by most lenders. They’re important to have if you ever decide to purchase a home, a car, or even something as simple as a new mobile phone, or connecting your electricity. Credit scores can range anywhere from 0 to 1200. The higher your score, the more money you can typically borrow and the less you have to pay for a loan. A low score can be considered “high risk.”

Bankruptcy, late payments or referrals to collection agencies can all affect your score negatively and this information can remain on your credit score for several years.

To know & monitor your credit score for free, visit GetCreditScore.com.au.

If your score is at the higher end, you may be eligible to negotiate for a better rate than what you currently have or have been quoted. On the other hand, if your score is toward the lower end, you may be able to find a provider that caters to your needs.

Via GetCreditScore.com.au, you can find out your credit score for free, and then see a number of offers on varying products, where some are customised to your credit score.

Equifax, previously known as Veda, operates as the leading credit bureau in Australia. A credit bureau is a company that collects and maintains people’s credit information and provides it to lenders, creditors, and consumers in the form of a credit report.

Credit bureau’s like Equifax exist to report on the credit worthiness of an individual which is valuable to credit providers such as Banks, utility providers and other lenders.

If your credit score is Below Average, you're in the bottom 20% of Equifax's credit-active population, suggesting it's more likely that you will incur an adverse event such as a default, bankruptcy or court judgment in the next 12 months.

If your credit score is between 510 and 621, your credit score range is Average. Your credit score would suggest it's likely that you will incur an adverse event such as a default, bankruptcy or court judgment in the next 12 months.

Your credit score suggests it's less likely you will incur an adverse event that could harm your credit report in the next 12 months. Your odds of keeping a clean credit file over this period are better than Equifax’s average credit-active population.

Your credit score suggests it's unlikely that you will incur an adverse event in the next 12 months that could harm your credit file. Your odds of keeping a clean credit report are 2 times better than Equifax’s average credit-active population.

You’re in the top 20% of Equifax’s credit-active population, suggesting it’s highly unlikely that an adverse event could harm your credit file in the next 12 months. Your odds of keeping a clean file are 5 times better than Equifax’s average population.